Blog

The Future of AI in Financial Planning

With NVIDIA Corporation nearly tripling its stock price so far in 2024 and surpassing Apple as the world’s most valuable company, there’s never been more interest in artificial intelligence (AI). Although NVIDIA isn’t an AI company per se, it supplies AI companies with critical infrastructure like graphics processing unit (GPU) chips. With this growing interest […]

Understanding IRMAA and How to Avoid a Surprising Surge in Medicare Premiums

Imagine this: You’re about to turn 65 and are excited to switch from private health insurance to Medicare, expecting to save money. But instead, you’re hit with a significant increase in your Medicare premiums. This has become a reality for many of our clients. In one recent situation, a married couple who had both turned […]

Navigating the Loss of the Stretch IRA Under the SECURE Act

Last month, I attended an intensive Friday-Saturday IRA workshop that focused on the many changes to IRA regulations in recent years. Ed Slott hosted the workshop. He’s a CPA and IRA expert, and you may recognize his name from the Retirement Freedom specials on PBS. I initially met Ed in 2005, the first time I […]

How Proposition 19 Can Reduce Your Property Taxes

In this month’s newsletter, I’ll recount a true story about my neighbor who got a terrible surprise on his property tax bill, although I’ve changed some of the details to protect privacy. Two months ago, he got a notice from the Orange County Assessor’s Office saying that his property tax bill had increased by $14,000 […]

How Safe Are Your Fidelity Accounts?

With the First Republic Bank, Silicon Valley Bank, and Signature Bank failures in the last two months, you may understandably be concerned about the safety of your money, including your bank accounts and Fidelity investment accounts. To start, a little background may help. Fidelity Investments is one of the world’s largest and most well-respected investment […]

Are California Taxes Really Higher than Most State Taxes? and The 2023 US Economic Outlook

A couple of months ago, one of our clients called me to ask about moving from California to Pennsylvania to accept a job promotion. We discussed several aspects of the move, including differences in the cost of living, housing prices, distance from friends and family, climate, local culture, and, very importantly, taxes. The tax question […]

Spiraling Up Is Now Available in Audiobook Format

When I announced the publication of my book Spiraling Up: Discover Financial Serenity, Make Work Optional, and Live Happily in Retirement earlier this year, I got quite a few questions about an audiobook version. Believe it or not, audiobooks surpassed ebooks’ sales figures three years ago and continue to grow at a double-digit pace annually, currently […]

Steve Medland Interviewed on the Retirement Revealed Podcast

In this episode of the Retirement Revealed Podcast, Jeremy Keil interviews Steve Medland to discuss his book, Spiraling Up: Discover Financial Serenity, Make Work Optional, and Live Happily in Retirement. The episode focuses on guiding you to financial serenity in retirement with Steve’s 7 principles. Steve discusses: Making work optional His work in investment management […]

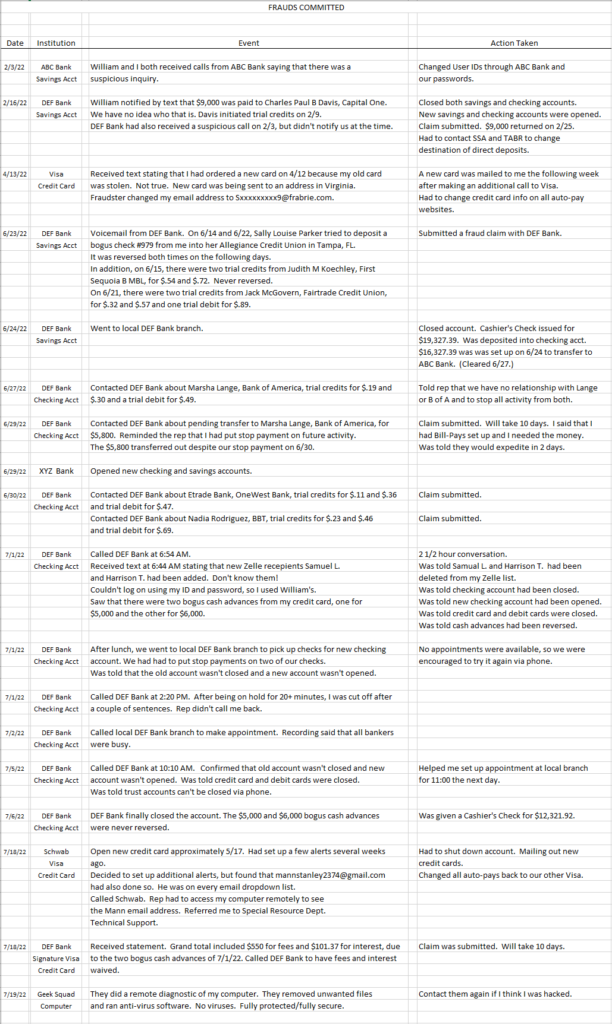

Cybersecurity: An Alarming True Story and How to Protect Yourself

On the morning of January 12, 2022, I took a quick look at my checking account balance, as I do most days. Instead of seeing around $9,000 or $10,000 as I had expected, the balance staring back at me was $109.97. Huh?! There had to be some mistake. I looked at recent transactions and saw […]